Picking the correct automobile insurance policy will be very laborious. When buying auto insurance coverage, worth is just one of many considerations.

Being a careful driver can really save you cash on insurance. Obviously, here. would reasonably insure good drivers and will provide decrease charges for good drivers, but do you know that inflicting an accident could make your insurance coverage rates almost double? It's abundantly clear that driving safely is among the best ways to keep your insurance coverage rates low!

Reassess what sort of car you're driving. Ongoing could also be based mostly on what sort of car you might be driving. from this source or SUV's can carry higher premiums because they've more liability and they're typically costlier to substitute or repair when they have been damaged.

When you actually do not use your automotive for a lot more than ferrying kids to the bus stop and/or to and from the store, ask your insurer about a low cost for diminished mileage. Most insurance firms base their quotes on an average of 12,000 miles per year. In case your mileage is half that, and you'll maintain good records showing that this is the case, you need to qualify for a decrease charge.

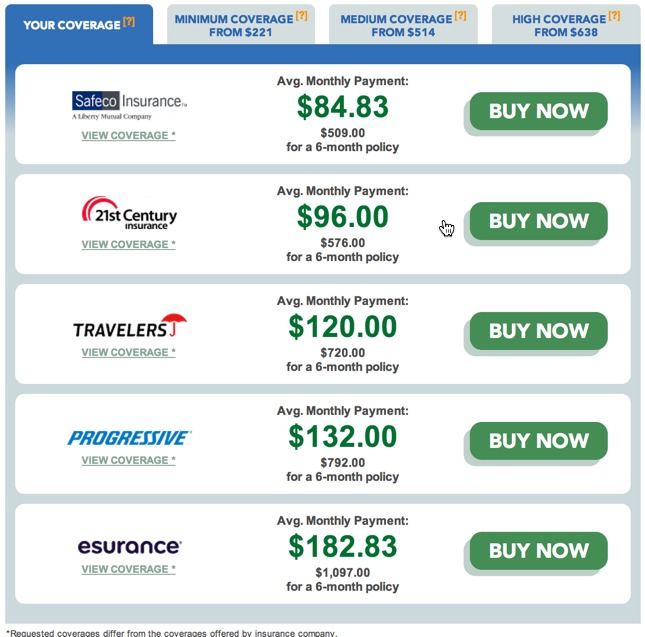

When on the hunt for car insurance, cut out the center man to save cash. Shopping on-line, directly via the corporate web site, is likely to save you probably the most cash. knowing it that enable you to buy online are pretty reputable and it is cheaper as a result of you aren't utilizing an agent.

In case you are in need of funds and desperate to reduce your insurance premiums, remember you may at all times increase your deductible to decrease your insurance coverage's price. That is one thing of a final-ditch maneuver, though, because the upper your deductible is the less useful your insurance coverage policy is. With a high deductible you'll end up paying for minor damages entirely out of your personal pocket.

In case your annual mileage pushed is low, your auto insurance premium ought to be, too. Fewer miles on the highway interprets straight into fewer alternatives for you to get into accidents. Insurance firms usually provide a quote for a default annual mileage of 12,000 miles. For Read the Full Document who drive lower than this make certain your insurance coverage firm is aware of it.

When you lately got married, offering that you and your partner have the same carrier, you may want to contemplate combining your partner's policy with yours or vice versa. Doing so can web you important savings because you'll be lumping two individual policies into one multi-vehicle policy, on which many carriers provides a discount.

If you live in a metropolis, own a automobile and you're getting car insurance coverage, it could also be clever to think about moving to the suburbs. By making this transfer, you might be saving thousands each year on your car insurance coverage, as it's all the time extra expensive in town.

As you can see, there's more to an auto insurance coverage policy than the price. Be sure you retain these things in thoughts as you choose your insurance supplier, to be sure that you do not get a policy that doesn't come through when you need it to. Keep Recommended Internet page !